Archives

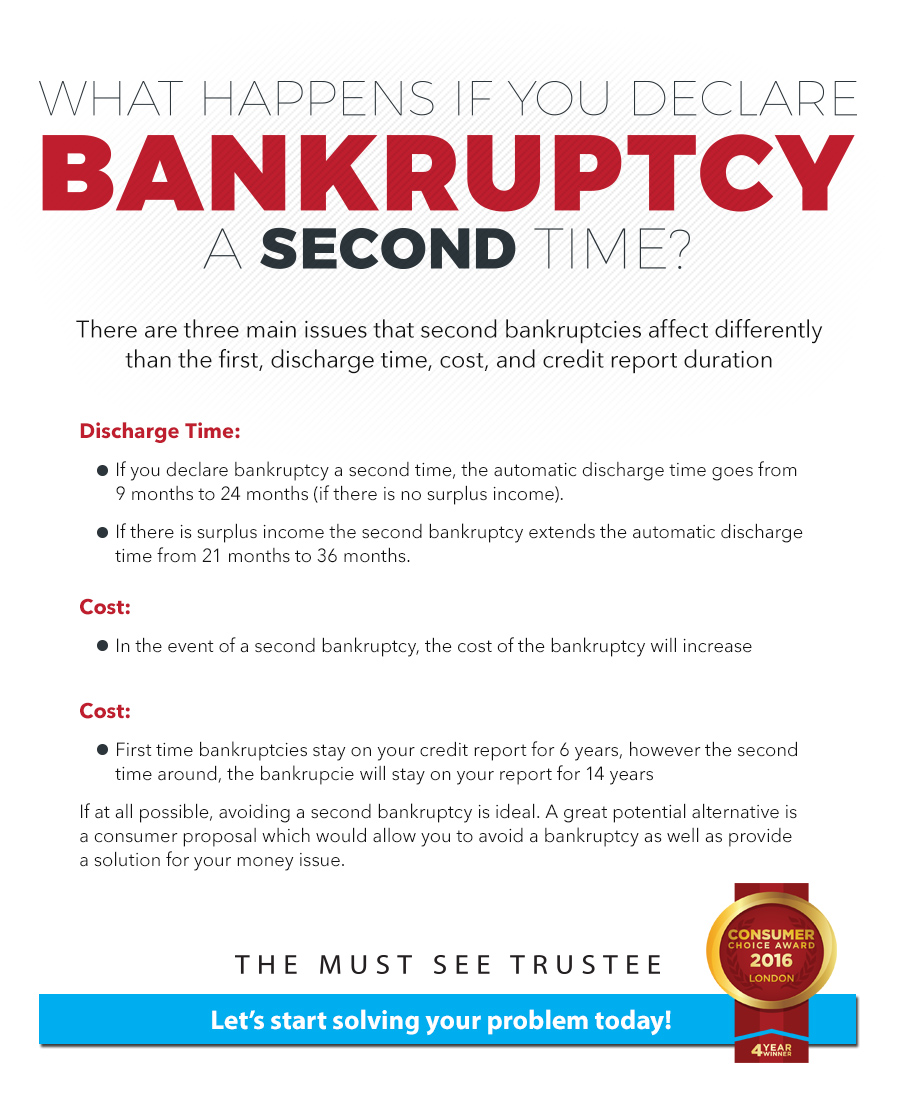

WHAT HAPPENS IF YOU DECLARE BANKRUPTCY A SECOND TIME?

There are three main issues that second bankruptcies affect differently than the first, discharge time, cost, and credit report duration

Discharge Time:

- If you declare bankruptcy a second time, the automatic discharge time goes from 9 months to 24 months (if there is no surplus income).

- If there is surplus income the second bankruptcy extends the automatic discharge time from 21 months to 36 months

Cost:

- In the event of a second bankruptcy, the cost of the bankruptcy will increase.

Cost:

If at all possible, avoiding a second bankruptcy is ideal. A great potential alternative is a consumer proposal which would allow you to avoid a bankruptcy as well as provide a solution for your money issue.